How Rising Interest Rates Will Affect Real Estate Prices

With rates now hitting 4% + for most loans before the Federal Reserve System (the FED) makes any moves, there is a lot of talk on how that may affect the market. Higher rates mean higher payments, and this will compress yields. So, this may not affect pricing quickly, but eventually, something will have to give.

We will work through an example similar to a deal we would do. We purchase a complex for $5,000,000 and take a 75% loan of $3,750,000. The total equity investment here is about $1,900,000. We will compare the difference at a rate of 3.69% to 4.69% with one year of interest-only payments.

3.69 % Example

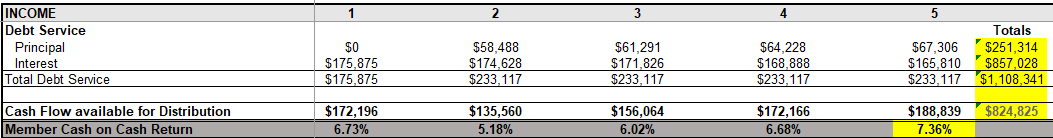

4.69 % Example

Understanding the Calculations

For simplicity, we will not go into detail about every calculation. The difference is about $142,475 less free cash flow in the 5-year period, which amounts to about 1.2 % less in return a year. Also, at the same time, because of how amortization schedules work with the lower interest rate, you are paying down $294,758 - $251,314 = $43,444 more principal. It’s important because the lower the rate, the quicker the principal is paid down. It’s an added benefit that we don’t think others ever really consider.

So now, to get about the same outcome of return with the higher interest, you need to pay $4,650,000. So, a 1% change in rate means you need a $350,000 or 7 % price reduction. It’s realistic for rates to get there.

On the property that we bought in Kansas City in November 2019; the rate is 4.79%. At that time, we thought that was a great rate. So, in a not very distant past, we were there. It’s just math if rates come up, prices need to come down, or returns need to compress even more. I just don’t see how they can squeeze more when returns are already lower. Even though we continue to get returns, others usually don’t.

We even heard from a broker recently that pricing has already gone down slightly on one listing because of rate movements. If rates go above 5%, you can see how it could continue to have price damage. Not sure if the FED will allow that, so we may not get there. We are watching closely to see what the FED does for the rest of this year. This doesn’t scare us because we always mitigate our downside and our longer-term approach can absorb swings in value. At the end of the day, you need to follow the math. That being said any price adjustment will most likely be mild.