How Rising Interest Rates Have Affected Real Estate Prices

With the Federal Reserve looking like they are done raising rates, the market has responded, bringing rates down in anticipation of the Fed bringing down rates next year. Higher rates have meant higher payments, which has compressed yields, affecting pricing relatively quickly.

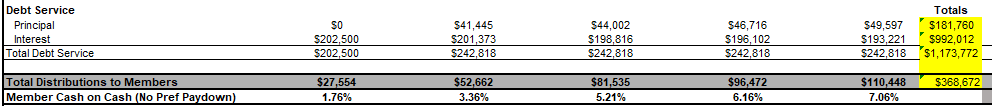

We will work through an example similar to a deal we would do of how these higher rates mechanically affect prices. Let's say we purchased a complex for $4,500,000 and took a 75% loan of $3,375,000. The total equity investment here is about $1,565,000. We will compare the difference at a rate of 3.69%(These are rates we were getting as late as April 22’) to 6%(Generally what the rate would look like for one of our deals today) with one year of interest-only payments.

3.69 % Example

6 % Example

Understanding the Calculations

For simplicity, we will not go into detail about every calculation. The difference between having a rate of 3.69 to 6 is about $266,883 less free cash flow in the 5-year period, which amounts to about 3.4 % less in average cash on cash return a year.

So now, to get an exact return outcome with the higher interest, you need to pay $3,700,000. So, a 1% change in rate means you need a $350,000 or 7 % price reduction. The movement in rates has a very powerful effect.

It’s just math if rates come up, prices come down, or returns need to compress even more. We are starting to see sellers become realistic and bring prices down.

We are watching closely to see what the FED does in 2024. They have indicated three rate cuts. However, higher rates could help us to buy better deals. Buying now at discounted prices at higher rates can create a similar return as before. The magic happens if you buy at today’s prices if rates come down you can refi into a much lower rate and juice your returns. We have began to see these pricing adjustments. This means that 2024 should be interesting to get some deals done since prices have adjusted and rates are starting to come down.