How to Vet a Real Estate Deal as an LP

We work with passive investors in our deals regularly. Each investor has different levels of sophistication. We have been in the passive role before investing in the deals of others. Most general partners claim conservatism but what that means is essential to know. We are writing this blog, so no matter what your level of sophistication, you will take in some nuggets that can help you when analyzing possible new investments.

First of all, this article has been written from the perspective that you have done your due diligence on the operating team. You feel comfortable with their ability to execute the business plan, and they are people of integrity. Next, we can jump into the market where the property is at. Does the market have the right factors that will allow the property to appreciate?

Some of the main factors to look into are:

Population growth

Income growth

Crime

Job growth

Location, Location, Location

We would suggest reading our blog post where we dig into these specifics. If this passes muster, then we can dig into the specific pocket the property is located in. You can dig into crime within that particular pocket. We also always like to see popular retail establishments close by. For example, we like seeing Panera Bread around. So, as they say in real estate “Location, Location, Location”.

Then we can dig into the investment offer itself. Here is where you can see things like return metrics, length of investment at a high level, etc. So, it’s good to know what your minimum return requirement is. You should be able to see what the equity split is between manager and investor. Also, see if there any split changes once specific metrics are hit, more commonly known as a waterfall. For example, on our deals, it’ll start at an 80/20 split and adjust to a 70/30 split once all investor’s capital investment has been returned. This will give a quick feel for the investment.

Explore the Property Description

From there, we usually dig into the property description. We like to see a good unit mix—a balanced mix of studios, one bed, and two beds.

In the property description, you will also find the year the unit was built. And as a rule of thumb, the newer, the better. That said, just because the unit is older, it doesn’t mean it hasn’t been well maintained and still has life. The last important thing to consider is how the average area rent compares to the current average rent on the property. You want to see there is at least some room for rents to grow.

Rental and Comparable Sales

The next step is to dig into the rental and sale comps. Since many of these buildings don’t sell regularly, you usually see comps that are a year or sometimes more out. You want to see these comps are ideally within five miles from the subject. Additionally, check to see a healthy mix of comps on price per door over and under the subject apartment. See that the comp units have a common year built, vacancy rate, finish, amenities, and complex size.

Remember that apartment complexes are valued on NOI (Net Operating Income), and comps can sometimes be misleading. You want the average price per door of these comps to be higher than what is being paid for the subject. Similar to the above goes for the rental comps. We would add making sure the subject future weighted average rent/price per square is at or lower than the average of all the comps. It can be higher than the average if the subject is a newer product or the outside grounds are present themselves better than the comps.

In the business plan, there a few things you want to see. This increase in rents across the board seems reasonable based on the rent survey and the amount of time projected to do so. This can change drastically based on if it’s a heavy value add or not. Is the exit price based on a conservative cap rate about half a point higher than the go-in cap rate? Lastly, does the capital improvement budget seem reasonable, and are there at least some estimates/ past costs on other buildings this is based on. This is especially important to dig into for the deals with more construction elements. Ultimately, you want to have confidence that the business plan is sound.

Financial Exhibits

Finally, we will dig into the financial exhibits. The first thing is to dig into if the vacancy and delinquency rates show larger amounts towards the beginning to account for some stabilization period. If they are showing other income, what does that mean? Does that include late fees, pet rent, RUBS (ratio utility billing system), etc.? When it comes to expenses, usually on these more significant multi-family deals, you will see this expense ratio at 50% at a minimum.

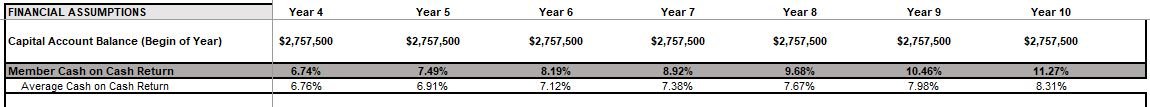

Also, it’s good to see what the break-even point is. For example, we like being around a minimum of 70-75% occupancy before we break even. What that means is that the income can offset all costs, including the mortgage. In financial projections, we also like to pay attention to what the yearly cash on cash is and what’s shown is the average of these years. So, if 8.5% cash on cash is projected, it will usually be less in the first one to two years. These are just some highlights to keep an eye on.

Every different investment will be unique to itself. What we talked about above are just typical things to look out for. If you can check off all the boxes we outlined above, the investment should run smoothly. Of course, this all assumes that you have the right team to effectively execute the specified business plan. We try to be as transparent as possible and provide plenty of information. And, we strive to deliver what’s needed upon request. Ultimately, there are risks, but if the proper due diligence was done and the appropriate business plan is executed, most of those risks should be mitigated.

If you are interested in learning more about our next deals Join Our Tribe!