Why JB2 is Investing in OKC

The JB2 Investments team first became interested in Oklahoma City in May 2020, after it became more challenging for us to find deals in Kansas City. We expanded our search to cities within a few hundred miles from Kansas City. Like Kansas City, we can reach Oklahoma City via a direct non-stop flight from LAX within just a few hours. We had some reservations about the Oklahoma City area at first. When our flight landed there for the first time, we took the extra time to check out all of the fantastic things to see and do in Oklahoma City. And once we saw all the redevelopment downtown, we never looked back.

Why JB2 Investments Invested in Oklahoma City

So, let’s dig into some of the data that allowed us to feel comfortable investing in the Oklahoma City area after realizing that we would be able to meet our return expectations.

“With the second-lowest-cost of living of any major metropolitan area balanced with high wages and one of the best places to start a business for the third year in a row, the Greater Oklahoma City area remains one of the best places to live, work and play.” Greater Oklahoma City Chamber

The JB2 Investments Five Factors Test

Oklahoma City passed the first “five factors” test that we look for when selecting a market. The five factors are:

Population growth – Oklahoma City is the 25th most populated city in the United States

Income growth

Crime

Job Growth

JB2 Investments “gut check”

Those are population growth (the 25th most populated city in the US), income growth, crime, job growth, and the gut check. We’ve been leveraging these five factors to use when selecting a market for a while, and we suggest that all of our investors do the same.

Once Oklahoma City passed the five factors test, we dug into the state of vacancy rate and rent growth. Oklahoma City has had a phenomenal performance during COVID, surpassing the results from the beginning of 2020 pre-COVID.

*Above is LA for reference

Oklahoma City Economic Growth

This growth has been evident with our current asset, as we can still push rents at renewal or new leases. On the topic of rent, it is essential to note that we wanted to make sure that we were in a landlord-friendly place. This asset is not subject to rent control, and there have been no talks of it, which is great to consider when investing in a new property.

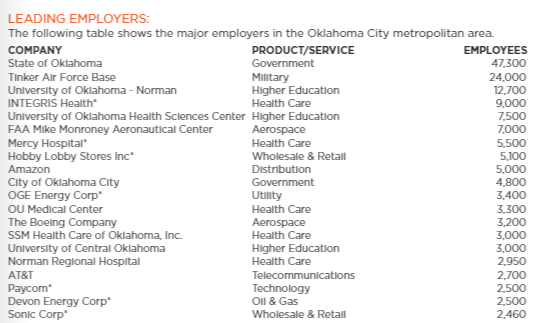

We also researched the leading employers in the area to understand the strength and future of the economy. Being the capital and the largest city in Oklahoma, the largest employer is the government.

After the government, the second-largest employment sector in the aerospace industry. Between FAA’s Aeronautical Center, Tinker Air Force Base, Boeing, Lockheed Martin, Northrop Grumman, and others, the industry is an economic driver of almost 44 billion a year. Check out this video below to learn more about the Aerospace industry in Oklahoma City.

Healthcare also packs a strong economic punch with 80,000 jobs, 36 general medical and surgical hospitals, and nine specialized hospitals. On top of Amazon’s current presence in Oklahoma City, they just announced that they will open another million-square-foot fulfillment center in 2021. This Oklahoma City-based fulfillment center will create 500 more full-time jobs in the area.

There is enough economic diversity that one sector alone cannot wholly devastate the economy.

Oklahoma City Wages and Rent Affordability

Based on the median household income of $53,973 and the average rent of $784 based on CoStar, we like the area’s affordability. We feel there is comfortable room for growth while still keeping with the theme of affordability.

Oklahoma City Awesomeness - Metropolitan Area Projects

We love the overall awesomeness of Oklahoma City. And the way we see things, it all started on December 14, 1993, when residents of Oklahoma City decided to bet on itself, voting into place a temporary sales tax. This funded the Metropolitan Area Projects (MAPS). These projects consisted of renovations to the Convention Center, Performing Arts Center, and Fairgrounds, construction of a 15,000-seat ballpark (Home to Minor League team of the Dodgers- Stadium reminds us of Petco Park in SD), a mile-long canal (Bricktown-home to shops/bars/restaurants), a 20,000-seat arena (Home to NBA Thunder), and the downtown library.

To date, this original MAPS program has had a direct economic impact of $7 billion. Since the first MAPS initiative, three more MAPS initiatives have been voted into place, meaning now billions in investment. It has brought about a resurgence of the downtown area with new parks like Scissortail Park, new streetcars, and the Olympic and Paralympic training center by the Oklahoma River, which traverses the edge of downtown.

The culture, food, and entertainment in Oklahoma City are great. Many excellent tasty restaurants (even us spoiled Los Angeles foodies can attest to the fantastic Oklahoma City food scene), venues, breweries, sports, great newer modern parks, and all kinds of activities year-round are abundant.

Even amidst the coronavirus pandemic, we have had the opportunity to enjoy these amenities in a limited capacity. The people in Oklahoma City have that Midwest friendly vibe, and it feels very similar to what we experienced in the Kansas City area.

We have had the opportunity to travel to a handful of American cities in our search for markets. With Oklahoma City, we just had this gut instinct that the market felt right and would hit the mark for JB2 and our investors.

Oklahoma City Transportation

Before we wrap, we need to mention as well the ease of transportation around the metro. You can pretty much get from one side of the city to the other within 20 minutes. Traffic is reasonable, and there is a well-designed freeway system.

Oklahoma City All the Way for Real Estate Investment

The combination of all the facts we discussed position Oklahoma City as a robust market. We are quite bullish on where it'll go in the future, especially with Americans moving to more affordable markets as remote working becomes a norm.